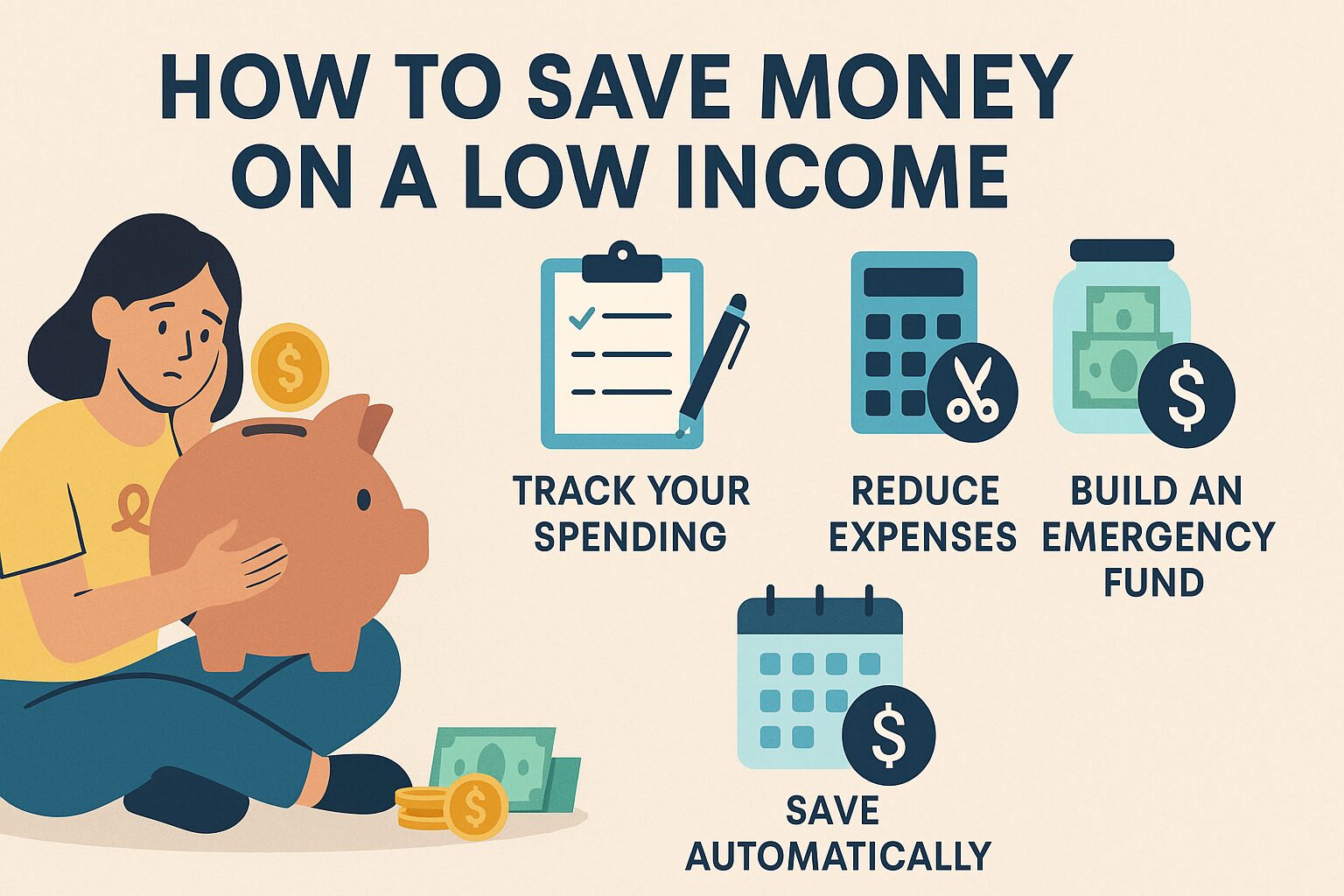

Discover how to save money on a low income with 17 smart, practical tips. Build savings, reduce expenses, and take control of your finances—starting today!

How to Save Money on a Low Income: Smart Strategies That Actually Work

Living on a low income doesn’t mean you can’t save money. It just requires a different approach — one that is intentional, creative, and focused on your long-term goals. Whether you’re a

How to Save Money on a Low Income:

student, working a minimum-wage job, or supporting a family on a tight budget, this guide will teach you how to save money on a low income without feeling deprived.

In this in-depth article, we’ll explore practical tips, mindset shifts, and tools that will help you build savings even when your income feels limited. Let’s get started.

Why Saving on a Low Income Is Challenging (But Possible)

Saving money when you earn a low income can feel like an impossible task. Rising rent, food prices, utility bills, and

unexpected expenses often consume most of the paycheck. However, the key isn’t necessarily earning more (though that helps) — it’s managing what you already have.

Saving is not just about the amount — it’s about building the habit of saving, no matter how small.

1. Track Every Dollar You Spend

The first step to saving money on a low income is to know where your money goes. Most people don’t realize how small purchases add up. Use a notebook, app (like Mint or YNAB), or a spreadsheet to track:Best Budgeting Apps for USA to Manage Money in 2025

Rent or mortgage

Groceries

Utilities

Subscriptions

Eating out

Gas and transportation

Entertainment

Tracking helps you identify spending patterns and cut out waste.

2. Create a Realistic Monthly Budget

A budget is your financial roadmap. It’s especially crucial for low-income earners because every dollar needs a purpose. Use the 50/30/20 rule as a guideline:

50% Needs (rent, food, utilities)

30% Wants (entertainment, subscriptions)

20% Savings & Debt Repayment

If 20% is too much, start with 5% or 10%. The point is to start somewhere.

Focus Keyword Tip:

When planning a budget, always think about how to save money on a low income by setting limits in each category.

3. Cut Non-Essential Expenses

This is where real savings begin. Review your spending and look for areas to trim, such as:

Cancel unused subscriptions (Netflix, gym, magazines)

Cook at home instead of dining out

Skip coffee shops – brew at home

Shop second-hand or discount stores

Limit online shopping and impulse buying

Frugality isn’t about depriving yourself — it’s about aligning spending with your priorities.

4. Use Cash Envelopes for Control

The cash envelope system is a budgeting method where you use physical cash for spending categories (like groceries or gas). Once the envelope is empty, you stop spending in that category.

This system can prevent overspending and create a tangible connection to your money — especially helpful when learning how to save money on a low income.

5. Build an Emergency Fund – Even $5 at a Time

An emergency fund prevents you from going into debt when unexpected expenses hit (car repairs, medical bills, etc.). You don’t need to start big — even saving $5/week can add up.

Open a high-yield savings account (like from Ally, Capital One 360, or Discover Bank) and set up automatic transfers — small, consistent savings matter.

6. Take Advantage of Government Assistance Programs

If you live in the U.S., several programs are designed to support low-income individuals and families. These include:

SNAP (food stamps)

Medicaid (health insurance)

LIHEAP (help with energy bills)

Section 8 housing

Free or low-cost school lunches

WIC (for women, infants, and children)

Don’t feel ashamed to use them — they exist to support you while you work toward stability.

7. Lower Your Utility Bills

Utilities can eat up your income if you’re not careful. Here’s how to reduce them:

Use energy-efficient lightbulbs

Unplug electronics when not in use

Turn off lights in empty rooms

Wash clothes in cold water

Adjust your thermostat seasonally

Many utility companies also offer budget billing or assistance programs.

8. Eliminate or Reduce High-Interest Debt

Debt can feel like a trap, especially when interest charges build faster than you can pay. Here’s what to do: https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/ways-to-save-money

How to Save Money on a Low Income:

List all your debts with interest rates

Pay minimums on all, but put extra toward the highest interest one (avalanche method)

Consider debt consolidation or credit counseling

Avoid payday loans — they are dangerous

When figuring out how to save money on a low income, removing high-interest debt is a game changer.

9. Shop Smarter for Groceries

Food is a major expense, but you can save without sacrificing nutrition:

Shop with a list and don’t shop hungry

Buy in bulk when possible

Choose generic over brand names

Use apps like Ibotta, Fetch, and Rakuten for cashback

Meal plan and use leftovers

You’d be surprised how much you can save by shopping strategically.

10. Get Creative with Side Income

Even if your main income is low, there are small ways to bring in extra cash:

Freelancing (writing, design, editing)

Babysitting or pet sitting

Selling crafts, clothes, or unused items online

Tutoring or giving lessons

Participating in surveys or cashback apps

Extra income can go directly into savings or paying off debt — a key part of how to save money on a low income in the U.S.

11. Take Advantage of Free Community Resources

Look into local resources that can replace things you’d otherwise pay for:

Free events and workshops

Public libraries (books, movies, internet)

Local food pantries or community fridges

Free fitness programs or parks

These can significantly reduce your monthly spending while still enjoying life.

12. Practice Delayed Gratification

Learning to say “not now” is powerful. Before making a purchase, ask:

Do I need this today?

Can I find it cheaper?

Can I wait a week and see if I still want it?

Delayed gratification helps you focus on long-term financial goals rather than instant pleasure.How to Save Money on a Low Income

13. Automate Your Savings

Set up automatic transfers from checking to savings — even $10 a paycheck counts. If you never see the money, you won’t miss it.

Some apps like Acorns, Chime, or Digit can help automate your savings with round-ups or small daily deposits.

14. Reevaluate Housing and Transportation Costs

These two areas usually take the biggest portion of your income. Consider:

Getting a roommate to split rent

Moving to a cheaper neighborhood

Using public transit or biking

Trading in your car for a more affordable option

Even saving $100/month in these categories makes a big difference over time.

15. Set Small, Achievable Financial Goals

Big goals can be overwhelming. Instead, try:

Save $100 in 30 days

Pay off one small debt in 2 months

Skip takeout for 2 weeks

Small wins build momentum, boost confidence, and help you feel in control.

16. Use Tax Refunds or Bonuses Wisely

If you get a tax refund or work bonus, don’t splurge. Instead:How to Save Money on a Low Income

Add to your emergency fund

Pay down debt

Buy something useful that saves money long term (like a reusable water bottle or rice cooker)

Treat this money as a tool, not a toy.

17. Educate Yourself About Money

Financial literacy can dramatically change your future. Free ways to learn:

Podcasts: The Budgetnista, Money Girl, Afford Anything

Books: The Total Money Makeover, Your Money or Your Life

YouTube channels: Graham Stephan, The Financial Diet

Blogs: NerdWallet, Clark.com, Mr. Money Mustache

The more you know, the more confident and in control you’ll feel.

FAQs About How to Save Money on a Low Income

Q1: Can I really save money if I live paycheck to paycheck?

Yes! Even small amounts like $5/week build the habit. Start with micro-saving and automate it.

Q2: What’s the best budgeting method for low-income earners?

Try zero-based budgeting or the envelope system. Both help allocate every dollar wisely.

Q3: How do I save if I have kids and expenses are high?

Look into child tax credits, SNAP, WIC, and free childcare programs. Also, involve kids in frugal living.

Q4: Should I focus on saving or paying off debt first?

Do both, but prioritize high-interest debt. Save a small emergency fund first, then aggressively pay debt.

Q5: How do I stay motivated to save?

Set visual goals (savings tracker jar), celebrate small wins, and remind yourself why you started.

Final Thoughts: You Can Save Money on a Low Income — One Step at a Time

Learning how to save money on a low income isn’t about being perfect — it’s about being consistent, intentional, and resourceful. Start with one or two small changes and build from there. Over time, those small actions add up to big financial wins.

Remember, it’s not how much you make — it’s how well you manage what you have.

About Us – जानवी कंप्यूटर कोर्स में आपका स्वागत है

नमस्कार दोस्तों,

janavicomputercourse.com पर आपका हार्दिक स्वागत है!

इस वेबसाइट का उद्देश्य घर बैठे कंप्यूटर शिक्षा, सरकारी योजनाओं, टेक्नोलॉजी टिप्स, और से जुड़ी जानकारी को हिंदी भाषा में सरल और सहज रूप में आप तक पहुंचना है l

हम कौन हैं?

मेरा नाम जानवी सरोज है। मैं वर्ष 2021 से कंप्यूटर और तकनीकी क्षेत्र से जुड़ी हुई हूँ। मैंने इस वेबसाइट की शुरुआत इस विश्वास के साथ की थी कि हर व्यक्ति को तकनीकी ज्ञान तक पहुंच होनी चाहिए — वह भी बिल्कुल मुफ्त में और अपने ही भाषा में।

हमारी वेबसाइट पर क्या मिलेगा?

janavicomputercourse.com पर आपको निम्न विषयों पर Step by Step जानकारी हिंदी में मिलेगी:

Computer Course Based on Latest CCC Syllabus

Introduction to Computers (हिंदी और इंग्लिश माध्यम दोनों के लिए

Basic to Advanced कंप्यूटर कोर्स की जानकारी

सरकारी योजनाएं एवं रिपोर्ट्स

1,शिक्षा और करियर

2.कंप्यूटर कोर्स

3.सरकारी योजना

4.सरकारी नौकरी

5.हेल्थ और फिटनेस

6.Finance (English

प्रधानमंत्री योजनाएं (जैसे जन धन योजना)

हमारा उद्देश्य

हमारा मुख्य लक्ष्य है –

“हर घर तक कंप्यूटर और टेक्नोलॉजी की पहुंच बनाना, वो भी सरल हिंदी में।”

हमारा मानना है कि डिजिटल भारत तभी सफल होगा जब हर व्यक्ति कंप्यूटर और इंटरनेट की बुनियादी जानकारी रखेगा। इसी दिशा में हम प्रयासरत हैं।

आपका सहयोग जरूरी है

आपसे निवेदन है कि वेबसाइट पर मौजूद ब्लॉग पोस्ट को अधिक से अधिक शेयर करें, ताकि ज्यादा लोग इसका लाभ उठा सकें।

आपकी प्रतिक्रिया और सुझाव हमारे लिए बेहद मूल्यवान हैं — इससे हमें अपनी सामग्री और सेवा को और बेहतर करने का अवसर मिलता है।

संपर्क करें

यदि आपके पास कोई प्रश्न, सुझाव, या कंप्यूटर कोर्स से संबंधित जानकारी है, तो आप हमसे संपर्क कर सकते हैं:

Email: devir848630@gmail.com

या हमारी वेबसाइट के [Contact Us Page] पर जाएं।

ध्यान दें: हम निरंतर प्रयासरत हैं कि आपको सटीक, अपडेटेड और विश्वसनीय जानकारी प्रदान करें।

धन्यवाद!

– जानवी सरोज और टीम